Borrowers

A more flexible finance partner, providing faster access to finance.

We can be far more flexible than a bank. We treat every Borrower and application on an individual case-by-case basis to provide first mortgage funding tailored to your needs right across New Zealand.

Why borrow with us

Tailored for you

We are able to provide first mortgage funding tailored to your needs in respect of properties right across New Zealand.

Faster approval

We lend our funds directly to borrowers, which enables us to offer quicker approvals and provide loans directly to applicants.

Loan security

All loans are secured by way of registered first mortgage over the property and additional collateral security guarantees if required.

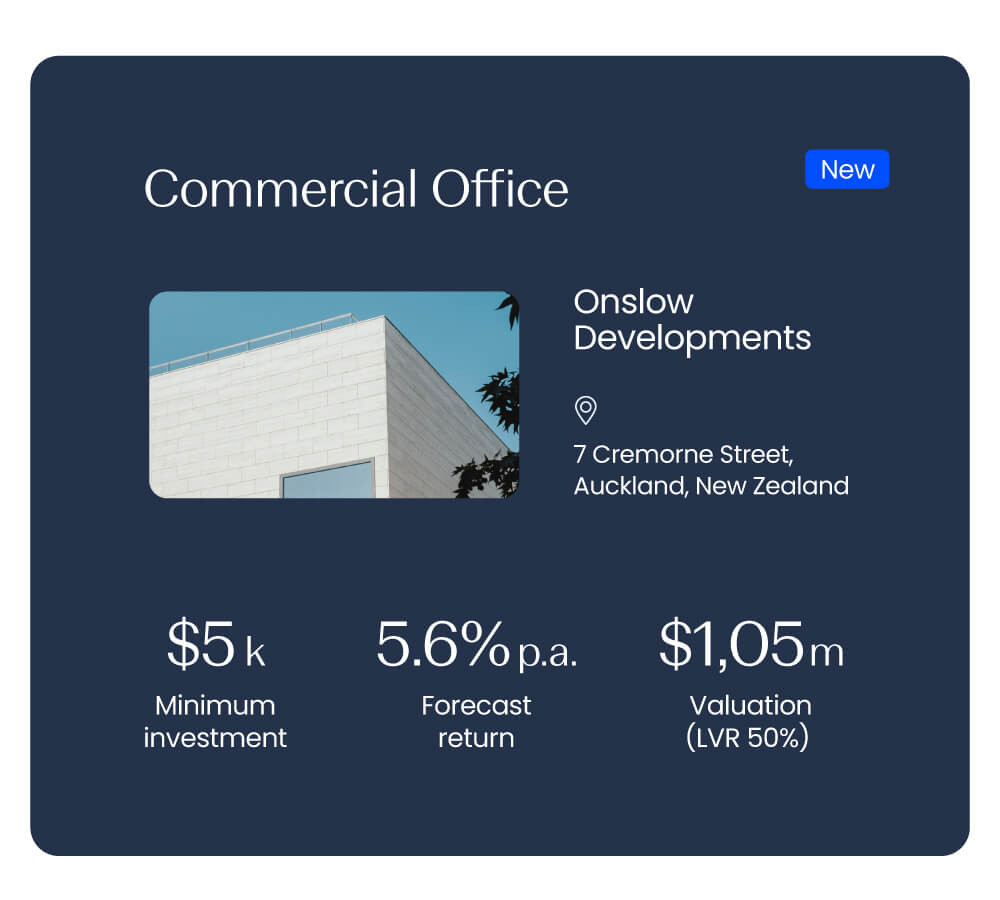

Loan to value ratio

We offer loans up to 50% of market valuation for vacant land and 70% of market valuation for properties comprising land and buildings.

Interest rates

We provide competitive rates that are transparent, fixed and allow our partners to plan and manage their finance and developments.

Variable terms

With highly flexible terms, our loans typically range from 6-24 months with an ability to provide loans which are variable to suit.

HOW IT WORKS

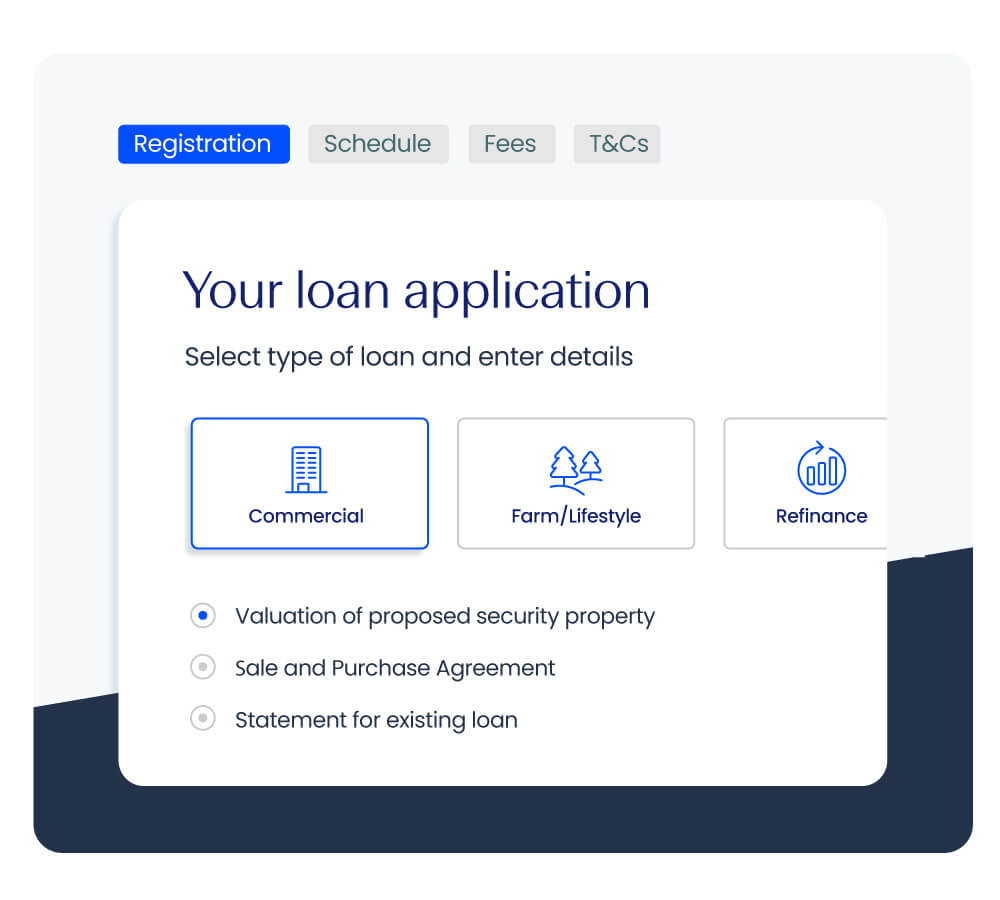

Complete your application and supporting documents

It's easy to apply for a loan with Endow - our application and assessment process is simple, convenient and transparent. Lending is available for a range of different activities, including but not limited to Bridging finance, Construction and Development finance, Commercial, Residential and more.

Apply to borrow

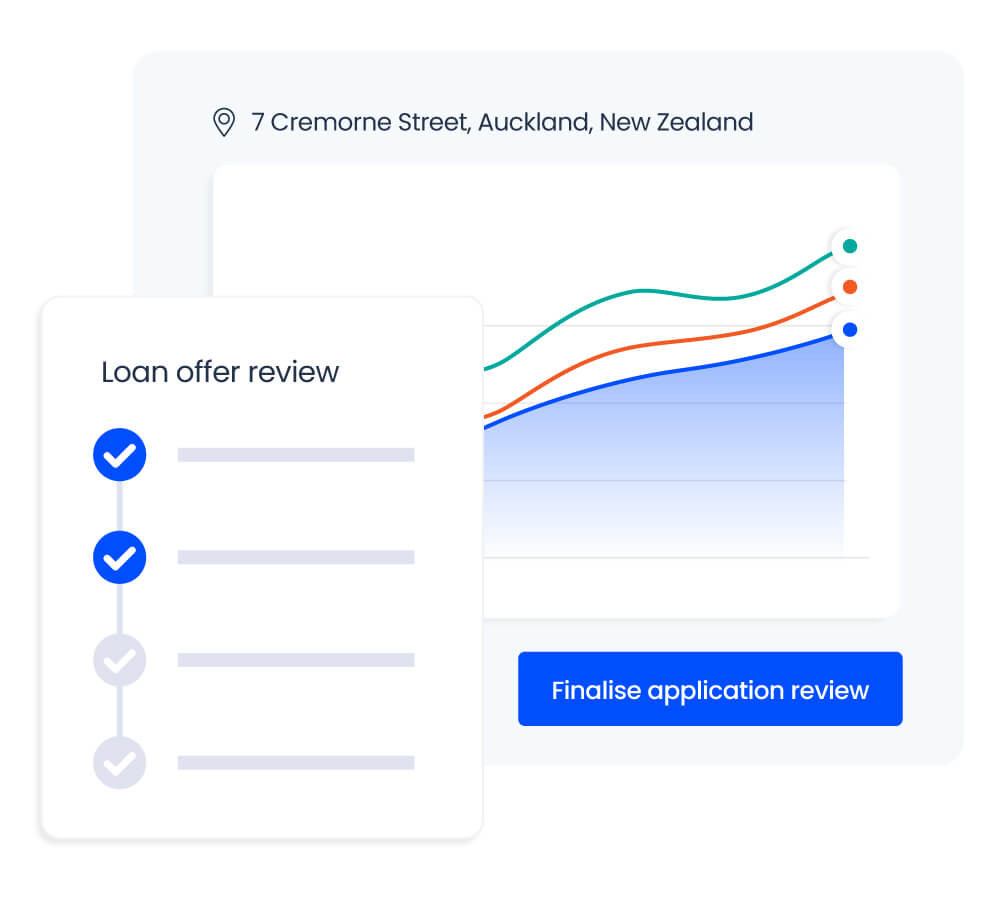

We review your application, then issue your loan offer.

Our experienced team will complete a credit check and review your application. If successful you will receive confirmation and a loan offer quickly.

Apply to borrow

Your property is added to our funds for Investors

Once the loan offer has been signed, we will offer your loan to our Investors for subscription and investment. We send you confirmation when your loan has been fully subscribed and instruct our solicitors to prepare the loan documentation.

Apply to borrow

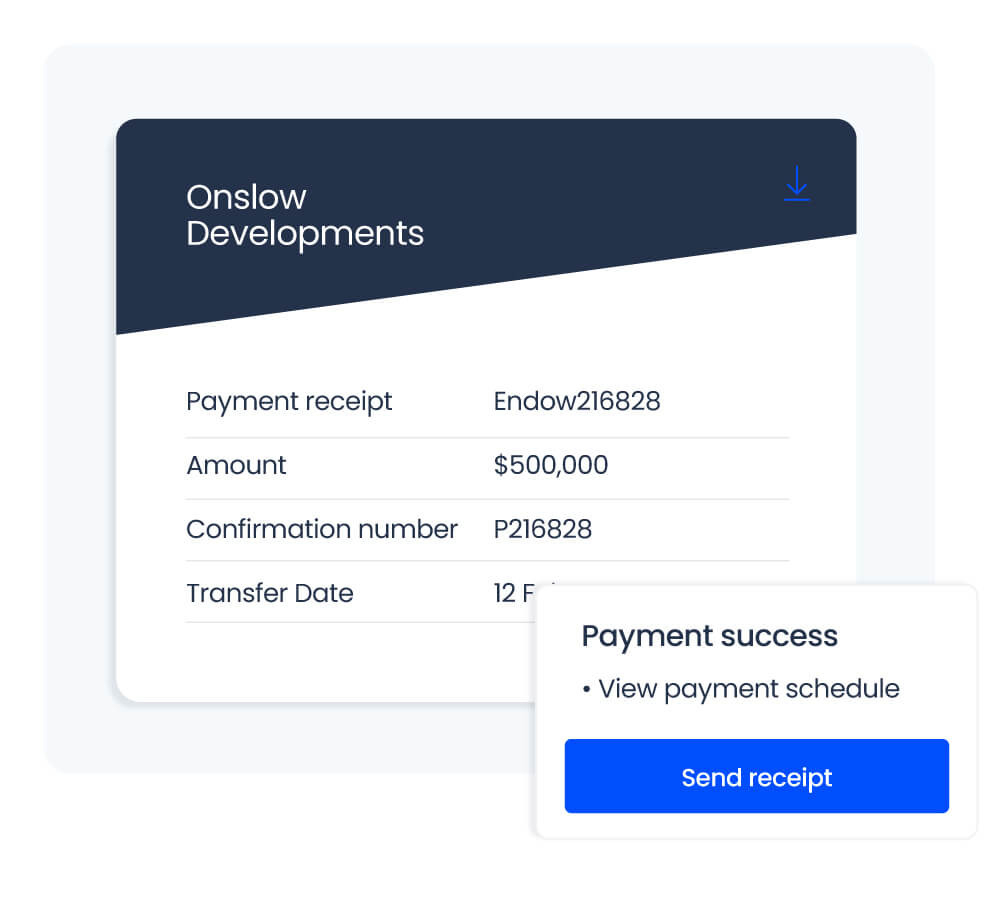

Once security is confirmed, you receive funding

Once our solicitor has received the signed loan documentation and our pre-conditions are satisfied, you receive your funding. Endow then manages the loan over its term.

Apply to borrow